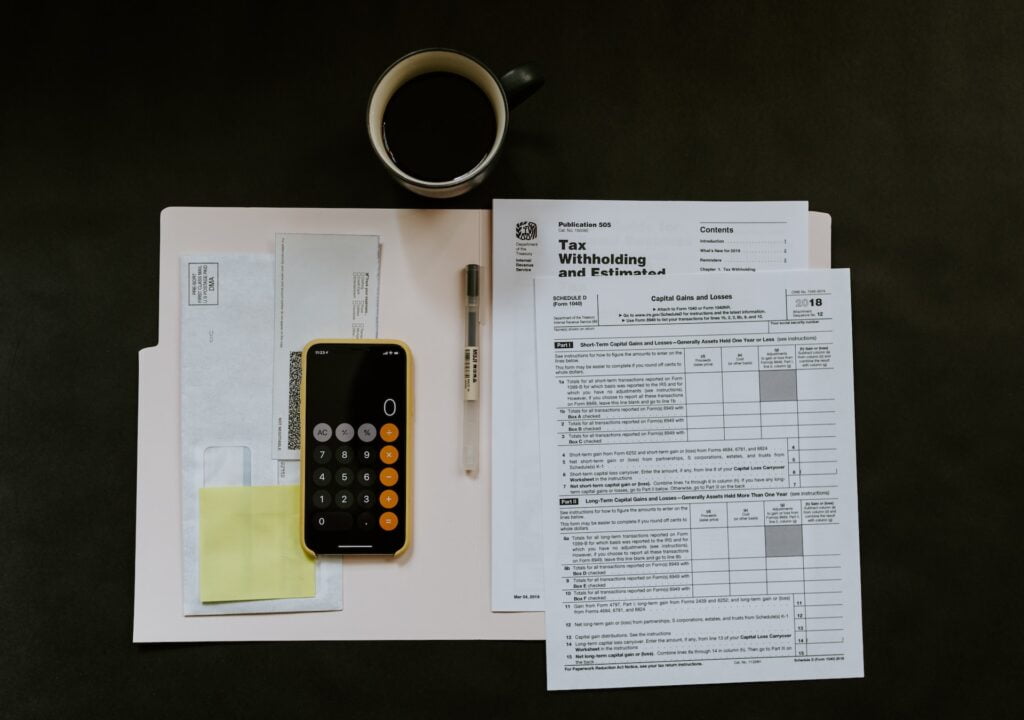

Lesson 1: Understanding PII in the Context of Tax and Accounting

Welcome to the exciting world of PII (Personally Identifiable Information) in the context of tax and accounting. What’s that? You thought this topic was going to be boring? Well, prepare to have your mind blown!

PII refers to any information that can be used on its own or in combination with other information to identify, contact, or locate a specific individual. This could include things like a person’s full name, address, or Social Security Number. PII is like the secret sauce in a delicious burger; it’s what makes the burger (or in this case, our client’s data) unique.

In the context of a tax, accounting, or CPA firm, we deal with a lot of this ‘secret sauce.’ Think about it: we handle our client’s names, addresses, social security numbers, and financial details. It’s like we’re entrusted with the recipe for the world’s most exclusive and tasty burger. And like any good chef, we need to make sure that recipe doesn’t fall into the wrong hands!

Remember, in our world, PII doesn’t include your client’s favorite color, favorite movie, or favorite restaurant. As fun as it might be to know these things (who doesn’t love a good movie recommendation?), they are not considered PII because they can’t be used to specifically identify an individual.

So, next time you’re handling client data, remember the importance of the ‘secret sauce.’ It’s not just about numbers and data; it’s about the trust and responsibility we have to our clients.